How Rising Hurricane Insurance Costs Impact Tampa Homebuyers

1. Why Hurricane Insurance Costs Are Rising

Catastrophe-Driven Pricing:

In 2024, powerful storms like Hurricane Milton and Hurricane Helene caused billions of dollars in damages across Tampa Bay. These catastrophe events have led to rising hurricane insurance premiums across Florida as providers adjust to increased claim payouts and risk exposure.

Climate Escalation:

Climate escalation refers to the increasing severity and frequency of natural disasters due to climate change—and it’s directly impacting homeowners insurance in Florida. Tampa Bay buyers are now navigating a market where climate-related risks are reshaping how we insure, value, and live in our homes.

2. What Tampa Homebuyers Are Facing Now

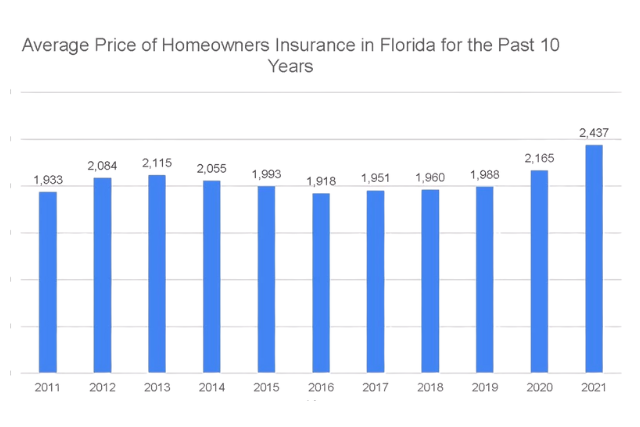

Florida Home Insurance Costs:

Homeowners insurance in Florida now averages around $2,625 per year—about 24% above the national average. In high-risk areas like coastal Tampa and St. Petersburg, those premiums can climb significantly higher.

Regional Insurance Variance in Tampa Bay:

While some inland areas around Tampa Bay have seen slight decreases or rate stabilization due to fewer direct storm impacts, barrier island and coastal communities—such as Clearwater Beach, Anna Maria Island, and parts of South St. Pete—are experiencing steep increases in insurance premiums due to higher wind and flood exposure.

Rising Flood Insurance Premiums:

Flood insurance, especially through FEMA's National Flood Insurance Program (NFIP), is also on the rise. Under the updated Risk Rating 2.0 system, many homeowners are seeing annual flood insurance rate increases of 18% or more—even if their home is not technically in a high-risk flood zone.

3. How Rising Premiums Affect Home Affordability

The Budget Squeeze is Real:

Rising hurricane and flood insurance premiums are adding to the financial pressure of elevated mortgage rates. Many Tampa Bay homebuyers are finding that insurance costs are shrinking their affordability window and forcing them to reconsider what they can realistically purchase.

Slowing Buyer Activity:

Some homebuyers—especially those using FHA or low down payment loan programs—are hitting pause on their home search as total monthly costs exceed loan limits or personal budgets. Mortgage delinquencies have also ticked up slightly as insurance costs stretch homeowner finances.

4. Expert Predictions & Market Stabilization

More Insurers = More Options:

Since 2023, over 10 new insurers have entered the Florida market, increasing competition and helping offset rate increases. This has created new opportunities for Tampa Bay homebuyers to shop around for more competitive homeowners insurance quotes.

Stabilizing Trends in 2025:

In 2025, insurance experts and market analysts are seeing early signs of stabilization. Thanks to decreasing reinsurance costs and regulatory reforms designed to reduce litigation and fraud, parts of the Greater Tampa Bay area—especially inland neighborhoods—are now seeing premiums begin to level off.

5. What Tampa Bay Buyers Should Do Before Closing

Compare Quotes Early:

Don’t wait until you’re under contract. Compare homeowners insurance quotes during your home search. Tampa buyers who shop policies across 30+ insurers can save 25–40% annually.

Look Into Wind Mitigation:

Invest in wind-resistant upgrades like impact windows, hurricane shutters, and roof enhancements. A wind mitigation inspection can unlock substantial savings on hurricane insurance in Florida.

Don’t Ignore Flood Insurance:

Even if a property isn’t in a FEMA-designated flood zone, buyers should request a flood insurance quote. Storm surge modeling and NFIP updates mean more homes are impacted than ever before—and premiums can be significant.

Understand Full Monthly Costs (PITI):

PITI—Principal, Interest, Taxes, and Insurance—should all be factored into your affordability. Rising insurance premiums can push your monthly payment above budget or preapproval limits.

6. Long-Term Outlook: What This Means for Buyers

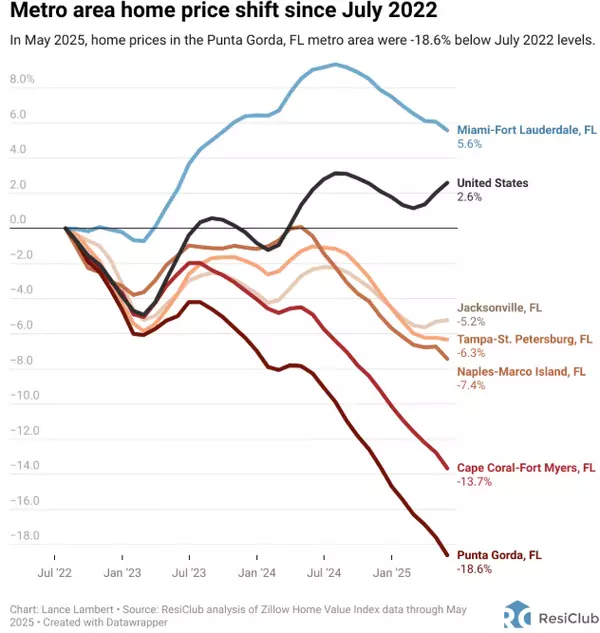

Insurance Now Affects Home Value:

In high-risk coastal zones, rising hurricane and flood insurance costs are beginning to influence how homes are priced and how long they stay on market. Insurance affordability is now a key resale factor.

Strategic Buying = Smart Buying:

Savvy Tampa Bay buyers are looking for inland homes with wind mitigation upgrades and lower overall risk exposure. These properties often offer greater long-term stability and affordability.

Sustainability & Resale:

Homes equipped with storm-resilient features—such as fortified roofs, impact glass, and elevated foundations—aren’t just cheaper to insure. They’re also more appealing at resale, making them a smarter long-term investment.

Final Thoughts & How I Can Help

As a St. Petersburg-based real estate advisor who serves all of Greater Tampa Bay, I help my clients navigate the full picture—not just the price tag. That includes:

-

Connecting you with trusted local insurance professionals

-

Reviewing risk zones and mitigation potential

-

Helping you understand what makes a smart, strategic offer in today’s market

If you have questions about how homeowners insurance could impact your home purchase—or you just want a clearer strategy for buying in Florida—I’m here to help.

Let’s connect and create a plan that fits your goals.

C: 813-702-2363

C: 813-702-2363

Categories

- All Blogs (33)

- 2025 Tampa Real Estate Market (14)

- Buyer (5)

- Buying & Selling Strategies (1)

- Buying Tips (6)

- Education (2)

- Flood Insurance (1)

- Florida Condo Market (1)

- Florida Home Buyer (1)

- Florida Home Insurance (1)

- Home Buyer (7)

- Home Seller (9)

- Homeownership & Planning (1)

- Hurricane Relief Resources (2)

- Investments & Rentals (1)

- Investor Tips (2)

- Local Lifestyle & Community (1)

- Luxury Real Estate (1)

- Luxury Real Estate Insights (1)

- Market Updates (1)

- NAR Updates (1)

- Neighborhood Spotlight (2)

- New Construction (1)

- Pinellas County Real Estate Market (1)

- Property Investor (1)

- Real Estate Investment (1)

- Selling Tips (7)

- St. Petersburg Real Estate Market (2)

- St. Petersburg, FL (2)

- Tampa Bay Luxury Real Estate Market (1)

- Tampa Bay Rental Market (1)

- Tampa Home Buying (7)

- Tampa Real Estate (5)

- Tampa Real Estate Market (9)

Recent Posts